Q: Mary messaged me via Facebook regarding this intriguing question, “Dear Derek: What if the majority of our assets are titled in only one spouse’s name (i.e., large 401ks, IRAs, etc.) and combined with the joint balance they exceed the individual applicable exclusion amount related to one estate in 2020—What can we do to avoid future estate taxes as a couple?”

A: Mary, this is a particularly important question for many of my readers, so thank you for creating this opportunity to discuss this today. An interesting provision within the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (“2010 Tax Relief Act”) allows an executor of an estate of a married decedent the option to transfer any unused estate tax exemption amount to the surviving spouse. Thus, for example, if a decedent used only a portion of his or her estate tax exemption, the estate could elect to have the remaining portion pass to the surviving spouse, giving the surviving spouse a larger estate tax exemption. Although this portability provision seems simple on the surface, it introduces important planning considerations and traps for the unwary.

When Congress created portability it gave us several new terms. The Basic Exclusion Amount (BEA) is the maximum estate tax exclusion amount allowed for a single decedent. The BEA is set by statute and indexed for inflation. For 2019 and 2020, the amount is $11,400,000 and $11,580,000 respectively. However, the BEA is reduced by prior taxable gifts.

The Deceased Spousal Unused Exclusion Amount (DSUE) is the estate tax exclusion amount a deceased spouse may transfer to the surviving spouse. It equals the deceased’s unused BEA. DSUE cannot exceed the lesser of: (1) the statutory BEA, or (2) the BEA of the last deceased spouse minus the amount on which the tentative tax on the estate of the last deceased spouse is determined. DSUE is calculated when the first spouse dies and is not indexed for inflation.

Most importantly, note that the election to transfer the unused exemption amount must be made on a timely filed estate tax return (Form 706). This means that many individuals will need to file an otherwise unnecessary return merely to make the election. Many practitioners are missing this key step, thereby creating significant issues for their clients. However, fortunately, several taxpayers have obtained relief from the IRS under § 301.9100-3 of the regulations by obtaining a Private Letter Ruling.

Furthermore, by making the election, the statute of limitations remains open for the decedent spouse’s estate tax return until the statute of limitations has run on the surviving spouse’s estate tax return.147 Thus, the IRS can audit the deceased spouse’s estate tax return (even after the normal statute of limitations has run) and add any increase in tax to the surviving spouse’s estate tax return.

The transfer of DSUE is limited by a number of rules. First, only the DSUE from the last deceased spouse may transfer to the surviving spouse; a surviving spouse cannot aggregate DSUEs or choose the largest DSUE from previously deceased spouses. Secondly, the transfer of DSUE requires marriage or privity.

Example 1. Last deceased spouse. H1 and W1 are married at the time H1’s death in 2011. Although H1’s taxable estate is $5,000,000, the executor of H1’s estate transfers the entire estate to W1 (via the unlimited marital deduction) and elects to transfer H1’s entire estate tax exclusion amount ($5,000,000) to W1 (i.e., DSUE). W1 then marries H2. In 2020, H2 dies with a taxable estate of $10,000,000, whereby the executor of H2’s estate chooses to utilize $9,000,000 of H2’s $11,580,000 estate tax exclusion amount. Based on these facts, the DSUE available to W1 is $2,580,000 (i.e., H2’s remaining estate tax exclusion amount).

Example 2. Privity. H1 and W1 are married at the time of H1’s death in 2011. The executor of H1’s estate transfers the entire estate to W1 (via the unlimited marital deduction) and elects to transfer H1’s entire estate tax exclusion amount ($5,000,000) to W1 (i.e., DSUE). W1 then marries H2. In 2020, W1 dies with a taxable estate of $10,000,000, whereby the executor of W1’s estate chooses to utilize $10,000,000 of W1’s $11,580,000 estate tax exclusion amount. Based on these facts, the DSUE available to H2 is $1,580,000 (i.e., W1’s remaining estate tax exclusion amount).

- While W1 had a $16,580,000 total estate tax exclusion amount ($5,000,000 DSUE from H1 + $11,580,000 BEA), only $10,000,000 was used.

- Of the $10,000,000 estate tax exclusion that was used, the entire amount was attributable to W1’s BEA.

- Therefore, only $1,580,000 of W1’s total estate tax exclusion amount (i.e., $11,580,000 BEA – $10,000,000 BEA used) may be utilized by H2.

- It is important to note that W1’s $5,000,000 DSUE estate tax exclusion amount from H1 is completely lost and cannot be used by H2.

The mechanics of how the exclusion transfers between individuals are not terribly complicated. However, analyzing whether to make the portability election can be. There are a number of factors which affect this decision:

- Size of the combined estate;

- Anticipated growth of the surviving spouse’s estate;

- Changes in the future estate tax law;

- Asset protection issues; and

- Additional basis step-up of property in surviving spouse’s taxable estate.

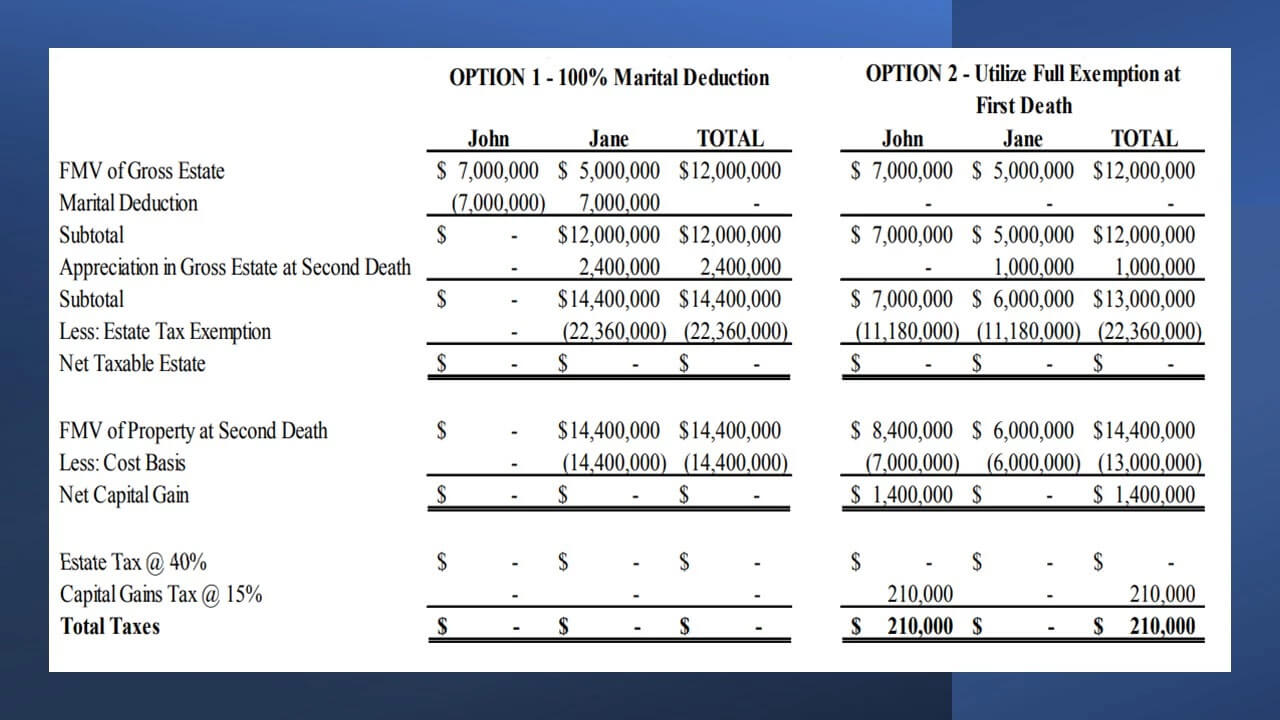

Example 3. John and Jane have a combined estate of $12,000,000. Assume that John dies in 2020 and Jane dies later that year.

The couple had two options at John’s death. The first was to transfer property to Jane using the Marital Deduction and file portability. The second option would be to use a portion of John’s exemption at his death.

The couple incurs some capital gains tax by utilizing the exemption at John’s death and since their combined estate is below the combined exclusion amount, taking John’s exemption at his death increases their tax liability. However, if Jane significantly outlives John, choosing to utilize the full exemption at John’s death may be prudent.

Example 4. Mike and Mary have a combined estate of $24,000,000. Assume that Mike dies in 2019 and that at Mary’s death at the end of 2019 the value of the total estate is $28,800,000 (20% growth rate).

The couple incurs some capital gains tax by utilizing the exemption at Mike’s death, however since their combined estate is above the combined exclusion amount because of its growth after Mike’s death, taking Mike’s exemption at his death decreases their tax liability.

Note that the couple does save some tax by utilizing the full exemption amount at the first death; however, the potential savings increase the longer the surviving spouse lives. In this case, given the huge assumed growth rate, the resulting tax savings could become dramatic over-time.

- In addition to the effect explained in Examples 3 and 4, moderate wealth taxpayers should have other considerations which might include:

- The state estate tax is decoupled states will remain a substantial cost;

- Inflation may push their estates above the thresholds, and

- The future may bring a lower exclusion amount; “Wait and see” may turn into “Wait and pay”

- Asset protection and related concerns

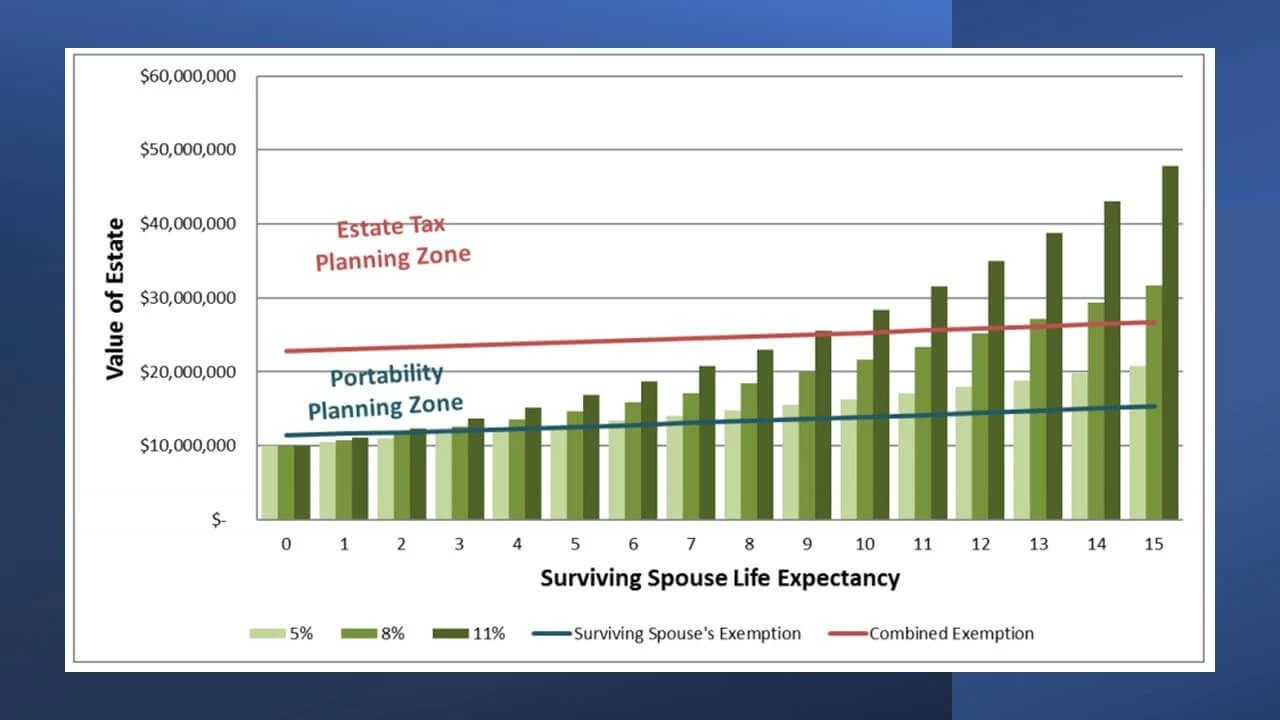

Example 5. Assume that an estate planning practitioner encounters a couple with a gross estate of $10M. The couple is resistant to filing Form 706 because of the associated costs. Depending on their circumstances that resistance to incur the associated costs might be prudent or very short-sighted as the following chart demonstrates:

The above chart projects the resulting size of the estate in relation to the two possible exemption amounts and considering three possible growth rates. Clearly, the higher the growth rate, and the longer the surviving spouse lives, the more planning that is necessary. Once an estate’s value exceeds the surviving spouse’s BEA (the blue line), it is prudent to file a Form 706 for portability. Once an estate value exceeds the combined value of the DSUE and BEA (the red line), it is prudent to consider a bypass trust.

Understanding portability and using it strategically can have a significant impact on taxpayers. The initial steps to understanding the new scheme and remembering to file for the election are overwhelmingly simple and important. The advanced strategy, which is analyzing whether to utilize the exemption at the first death or to wait until the second death, is considerably more complicated, has a narrow application, and involves more unknowns; however, it is very powerful. Please email me to work with your tax advisors to properly plan for this potential necessity within your estate at askme@dearderek.com.