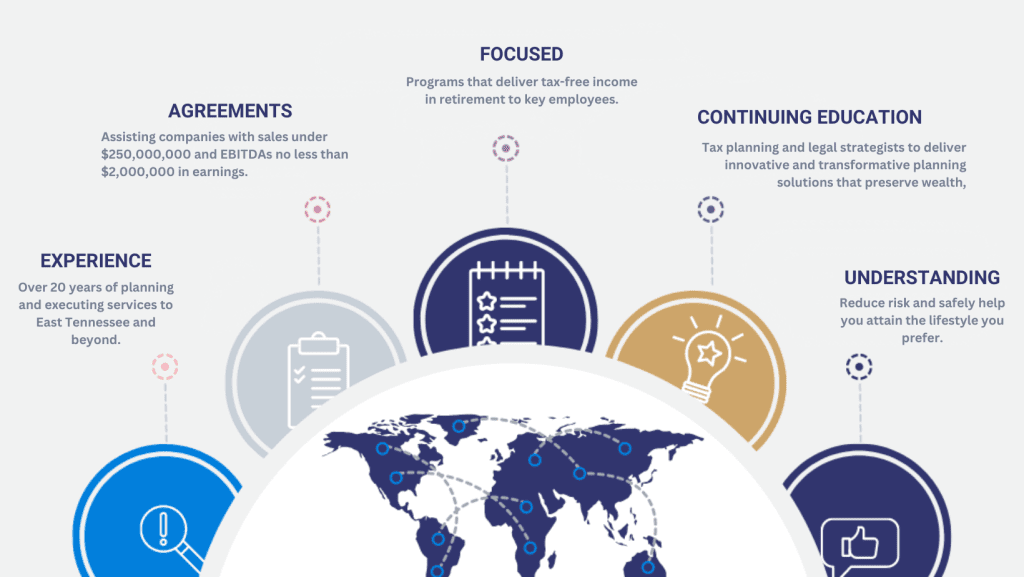

The unique investment banking ability of Miser Wealth Partners, LLC, to protect and maximize your most valued asset is “hand in glove” with the mission of our wealth management division. For most small business owners, the issue has always been that most investment banks centered on servicing the institutional client or the multinational conglomerate business. We only work with companies operating in the $2 million to $250 million EBITDA space. That is considerably different from what you will find at most investment banks like Morgan Stanley or Goldman Sachs.

What we found is that those skillsets are not necessarily aligned to serve the entrepreneurial client. For that reason, we decided to approach this in a different way and create an “outsourced model.” An investment banker that is serving the institutional client in many cases could be conflicted because they are representing a business on the institutional buy-side that we may be marketing. Therefore, we believe having the independent adviser enables the entrepreneur access to the best representation of the interest of the business owner without conflict, which is critical to running a disciplined process.

How does Miser Wealth Partners’ process differ from other firms?

First of all, our process is unlike what you may have experienced at the majority of wirehouse investment banking groups that are really more aligned to serve the development offices of the large multinational business. They may have forgotten to tell you that they spend much of their time providing strategic financial advice to these giant corporations as they are considering what businesses to enter or acquire or what businesses are out of favor or could be disbanded and/or sold. Also, these same investment bankers in those capital markets are supporting the treasury office of those large multinational conglomerates, helping them ideally position their balance sheets to debt and equity underwriting in the public market. That is where these investment banks earn their high revenues underwriting new issues for their respective firms.

Over the last 20 years, we have researched the overall boutique investment banking market and executed exclusive formal referral agreements with over 43 firms that employ over 1,200 investment bankers who specialize in advising small companies like yours. We have profiled each of those 1,200 investment bankers’ experiences. We know the industries in which they have spent their careers understanding and conducting business, and we know the types of deals that they focus on—whether it is placing capital or executing merger and acquisition assignments. It’s our job to dive deeply into each of these bankers’ businesses and thoughtfully introduce a select few of whom we believe have the ideal credentials to serve you and achieve your objectives, whether that’s to raise capital, recapitalization, or sell your business.

Another benefit of our process is that we are able to select firms that have fee structures and industry expertise as well as the regional presence to bring the minimum bar down to where we can deliver exceptional institutional caliber investment advisory services. We can do that for companies as small as those with a $10 million enterprise value. Larger international banks typically don’t pick up coverage until a company exceeds $250 million and above in value.

Does Miser Wealth Partners offer pre-transactional advice?

One of the things that we ideally look to achieve by having a network of talented investment bankers with strong industry knowledge real-time experience is to be able to provide a client with pre-transactional advice. We are currently experiencing the most active solicitation market we have seen during the past five market recoveries.

The mergers and acquisition, in general, are like any efficient marketplace driven by forces of supply and demand, and there is an extraordinary amount of demand right now that you may be experiencing in the form of solicitations from suitors. There are two primary buckets, and buyers in both are very flush from capital. So, they are under pressure to find ways to deploy the capital to return a profit to their shareholders. The first is private equity firms.

When a private equity fund raises money for institutional investors, like pension funds and insurance companies, they typically receive a six-year commitment from those investors to back them in transactions or to provide the equity to deploy. So, when they raise a fund, they will typically have six years. This is important because their six years are up with many of the funds, but there’s still a tremendous amount of money that remains unused.

The average life of those private equity funds is normally five to six years and the charity of those funds that were placed with the private equity companies are maturing. What a private equity firm makes from an investment or acquisition, they’re typically investing with the objectives to build that business then recap it or sell it within a three- to seven-year time horizon.

What to do next when considering selling my business?

When entrepreneurs are considering the potential sale of their business, ideally you want to consider a deal when capital markets are receptive. When your company is in a good healthy position showing an opportunity for growth and capital markets are aligned as they are today, it becomes time to consider capitalizing on the timing of the market.

One of the things that we pride ourselves on is the ability to introduce you to one or more investment bankers that know your segment of the market inside and out and can give you pre-transactional advice. Counter that to the slippery slope of opening your doors and welcoming in one of the solicitors to do their due diligence. This is really one of the core reasons we developed the “outsourced model,” which is to protect our clients from exposing their business to a potential competitor who laid an attractive nonbinding letter of intent in front of you.

We believe a much less risky proposition and a much more preferable way to go about it would be to have some pre-dialog with our qualified investment banker who is looking to earn the right to represent you and to provide you with some very sage guidance based on firsthand experience within the market. Our approach is to evaluate the business where it stands today and whether the timing is appropriate based on your microeconomic conditions within the overall economy if it makes sense then to approach the market. If all indicators align properly, we would advocate hiring a banker to run a competitive process.

What should I consider when seeking investment banking options for my business?

For businesses with less than $250 million in annual revenues, the best investment banking solutions typically revolve around providing advisory services that help optimize financial strategies, facilitate transactions, and support growth initiatives. Below are some investment banking solutions that can be beneficial for such businesses:

- Mergers and Acquisitions (M&A) Advisory: Investment banks can assist in mergers, acquisitions, and divestitures for small and medium-sized businesses. They provide guidance throughout the transaction process, including valuation analysis, due diligence, deal structuring, negotiation support, and post-transaction integration strategies.

- Capital raising: Investment banks can help businesses raise capital to support growth initiatives, expansion plans, or refinancing needs. They facilitate debt financing, equity offerings, private placements, or mezzanine financing by leveraging their network of investors and financial institutions.

- Strategic partnerships and joint ventures: Investment banks can identify and facilitate strategic partnerships or joint ventures that can benefit small and medium-sized businesses. They can assist in finding potential partners, negotiating agreements, and structuring mutually beneficial arrangements that drive growth, market access, or operational synergies.

- Debt restructuring and refinancing: Investment banks can assist businesses in optimizing their debt structure by refinancing existing debt, negotiating better terms with lenders, or restructuring debt obligations. This can help improve cash flow, reduce interest expenses, and strengthen the financial position of the business.

- Strategic advisory services: Investment banks can provide strategic advisory services to help businesses develop and execute growth strategies, market entry plans, or diversification initiatives. They offer insights, market analysis, and strategic recommendations tailored to the specific industry and business objectives.

- Business valuation and financial modeling: Investment banks can provide business valuation services, which are important for various purposes, such as transactions, fundraising, strategic decision-making, or succession planning. They also offer financial modeling and forecasting to support strategic planning and scenario analysis.

- Exit planning and succession: Investment banks can assist business owners in developing exit strategies and succession plans. They provide advice on maximizing business value, preparing the business for sale, identifying potential buyers or investors, and executing the transaction to achieve the owner’s desired outcome.

- Fairness opinions: Investment banks can provide fairness opinions, which are independent assessments of the financial fairness of a transaction or offer. This can be important for transactions involving related parties, changes in control, or significant corporate actions, ensuring transparency and protecting stakeholders’ interests.

Why choose Miser Wealth Partners to manage your investment banking solutions?

It’s essential for businesses to carefully evaluate the capabilities, experience, and track record of investment banking firms when considering their services. The advisors at Miser Wealth Partners have a strong understanding of the specific industry, market dynamics, and the unique needs of small and medium-sized businesses in East Tennessee. We’ve helped a number of businesses, and we can help you too. C