Q: John emailed last week and asked, “Dear Derek: Over the years, I have loaned money to my immediate family and was wondering if that could benefit me in other ways going forward?”

A: John, Intra-family loans can be a very strategic estate planning move. When interest rates are exceptionally low, intra-family loans can produce substantial tax-free transfers for families with estates subject to wealth transfer tax. The mechanism for producing this tax benefit is a simple rate arbitrage. If parents loan money to their children at a low-interest rate and the children can invest the borrowed money at a higher rate, the difference represents a tax-free increase in wealth for the children.

With the gift and estate tax applicable exclusion amount set at $11,580,000 for 2020, most parents need not be concerned with the gift tax consequences when they shift wealth to their children.

On the surface then, it might appear that such parents should just make outright gifts if they want to shift wealth to their children.

However, intra-family loans may still have value for such families. Loans are still useful for parents who are not willing to give up money permanently or who need some cash flow from the property even if it is less than the cash flow they could otherwise earn. In addition, some parents do not want children to obtain money too easily. If the children must repay a loan, they will learn that they must work for money even if interest is payable at a rate below the market rate.

Parents would also have some flexibility in determining the interest rate on the loan. They could set the rate higher than the minimum AFR, but still significantly lower than the market rate of interest.

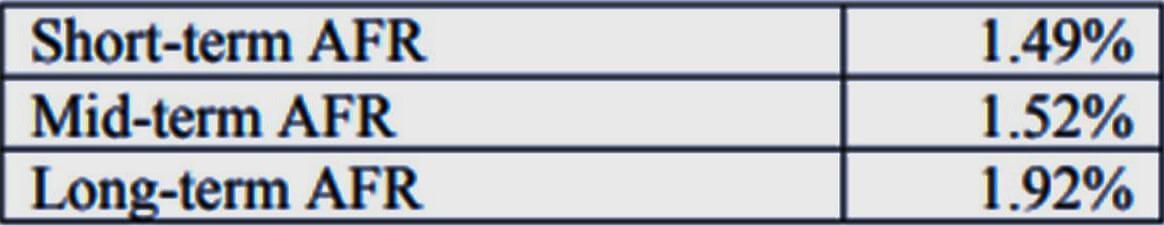

Speaking of low-interest rates, let’s look at a few upcoming examples to better understand how to properly utilize such loans for your family. The minimum interest rate that must be charged on a note is the appropriate applicable federal rate (AFR) for the month of the transfer. For notes with terms of three years or less, the short term AFR is used, for notes with terms of more than three years, but not more than nine years, the midterm AFR is used and for notes with terms of more than nine years, the long-term AFR is used. For March 2020, the semi-annual AFRs were as follows:

Example 1. In March 2020, Father loans $1,000,000 to his son Bill and takes back a 12-year, interest-only balloon note. The interest rate on the note is 1.92% (equal to the long-term AFR for the month of the transfer). Bill is able to invest the $1,000,000 to produce a 10% after-tax return. At the end of the 12-year period, Bill’s investment has grown to $3,138,428. The amount due on the loan is $1,212,631. The difference ($1,925,797) is a tax-free transfer of wealth

Parents might also loan money to children not to invest, but to reduce interest payments on a mortgage. Avoiding interest payable at a high rate on a mortgage would have the same effect as investing the borrowed funds at the interest rate on the mortgage.

Example 2. Mark and his wife, Alice, have a $400,000, 30-year mortgage with interest at 7% that allows prepayment. They have no equity in the house so they can’t refinance and their current monthly mortgage payment is $2,661.21. Mark’s parents loan them $400,000 that they use to pay off the mortgage. The loan has a 20-year term with interest at 1.92%. The new loan reduces Mark and Alice’s monthly payment to $2,009 and shortens the term by ten years.

For the loan to be respected by the IRS, it must be a bona fide loan. The family members must observe all loan formalities just as they would if the loan was between unrelated parties.

Less Affluent Transferors

With the gift and estate tax applicable exclusion amount set at $11,580,000 for 2020, most parents need not be concerned with the gift tax consequences when they shift wealth to their children. Thus, the transfer tax benefits illustrated in the previous examples would not apply to them. On the surface then, it might appear that such parents should just make outright gifts if they want to shift wealth to their children.

However, intra-family loans may still have value for such families. Loans are still useful for parents who are not willing to give up money permanently or who need some cash flow from the property even if it is less than the cash flow they could otherwise earn. In addition, some parents don’t want children to obtain money too easily. If the children have to repay a loan they will learn that they have to work for money even if interest is payable at a rate below the market rate.

Parents would also have some flexibility in determining the interest rate on the loan. They could set the rate higher than the minimum AFR, but still significantly lower than the market rate of interest.

Income Tax Considerations

If the children invest the borrowed funds in a property that will produce investment income (e.g., interest or dividends) or property purchased in the expectation that it will increase in value and be sold at a gain, the children would have an interest deduction and the parents would have interest income. This interest deduction would be limited to the total amount of the children’s net investment income for the year (IRC § 163(d)(1)). Subject to certain limitations, mortgage interest would also be deductible by the children and taxable to the parents (IRC § 163(h)(3)).

Mortgage Loans

Mortgage loans might be particularly favorable for a family, providing benefits for both the borrower and the lender. Advantages for children borrowing from parents rather than a bank might include:

- A lower interest rate;

- More flexible terms;

- Avoidance of origination and other transaction fees;

- Ability to borrow even with a poor credit rating;

- No increase in the interest rate for a poor credit rating; and

- A parent may not insist on a down payment.

Advantages for the parents include

- (1) Keeping interest payments in the family, and

- An income stream that may exceed the return on CDs or a bond portfolio.

The downside for parents is that they may be taking significant risks by offering more favorable terms than a bank would.